Global Market Crash and COVID19

I am coming back to my blog after a long hiatus pushed by friends to share some thoughts about the current state of affairs.

I have a few points to make regarding the Corona Virus - "COVID-19" and I will try to get into enough detail for each of them, whoever would like to have additional details or supporting data please get in touch. Click the link https://affinitasconsulting.com/ to reach out to me.

1, This Crisis has been in the making for some time, the Coronavirus "Covid-19" has been the perfect storm;

2, The deleveraging process is far from completed just in case you are thinking about “buying the dip”

3, Role of national governments vs. supranational organizations in this time of need has taken center role. EU failure at addressing the emergency at the medical level and at the financial level.

4, Unless global governments step in heavily to subsidies/ subsidize all parts of the economy with a specific focus on SMEs, it is likely that this recession will take much longer to recover.

A) Tax deferrals will not work (income tax, VAT submissions, etc.) B) QE at the banking level has produced diminishing returns since many years and it will be proven not enough to restart the economy. C) Only vouchers or any system to hand over money to families and SMEs may help, only if it is done FAST, I mean days or maximum 3-4 weeks.

5, Agile economies like the USA with little to no welfare parachute for employees (Or Gulf States for that matter) are bound to suffer faster and deeper negative effects. Employers facing a clear and possible long-term demand drop will let the workforce go to reduce operating costs and try to manage the storm. Current level of household debt in the USA implies that many households will not have the savings necessary to weather the storm.

1,FINANCIAL MARKETS WERE PRIMED FOR A CORRECTION BEFORE THE CORONA CIRUS "COVID19"

Setting aside the Corona Virus "Covid-19" domino effect, I want to point out that the Global financial markets were primed for a correction since some time ago.

FEDS (Federal Reserve System) had been adjusting their strategy for many months before this, kindly remember the tapering reversal which happened October 2019, prompted by unforeseen stress in repo operations.

Since last October the Feds started their purchasing program again.

Feds balance sheet BEFORE the Coronavirus crisis stood at 20% of the US GDP.

In Europe the German locomotive has shown clear signs of slow down due to the US-China trade war and Brexit, not to mention the chronic deterioration of demand from inside of the EU market. Please refer to macroeconomic data from Germany over the past 6-9 months for evidence.

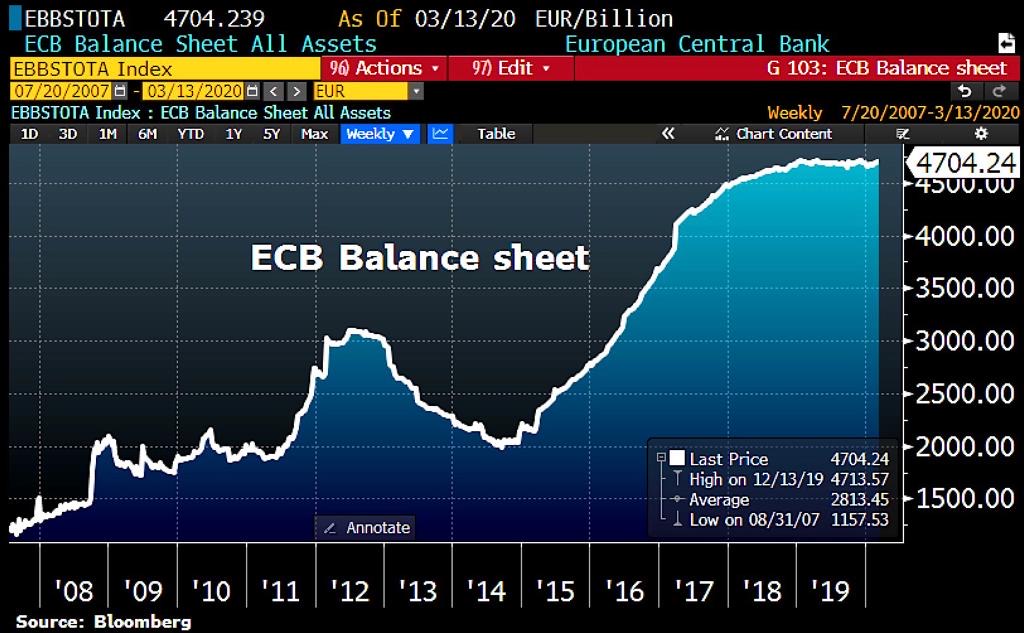

The ECB has been supporting silently expanding its balance sheet on a consistent basis, prior of the Coronavirus crisis ECB balance sheet stood at 40% of the Eurozone GDP.

For the sake of keeping a global view, please note that Central Bank of Japan (BOJ), after 20+ years of QE has a balance sheet value representing 105% of Japan’s GDP.

Extra low interest rates had fueled corporate buybacks, that have been propping up the equity markets as opposed to general small investors. It is known that small investors have reduced their market participation since the last crisis due to the polarization of the income levels and the gradual disappearance of the middle class, phenomenon typical of the post 2008 world in Western countries. Exceptions remain: China and India, presenting though other systemic issues which are not part of the scope of this article.

2. DELEVERAGING PROCESS FAR FROM COMPLETE

I have been listening to several TV commentators on various US channels like Bloomberg or CNBC that this is a great opportunity for investors to “buy the dip”. Clearly those individual miss the point and the nature of the retrenching we are seeing. We were heading towards a recession, even if the virus outbreak was only affecting China, let alone the rest of the world. The Chinese economy in 2019 is estimated to have represented 19.24% of the global GDP (data: https://www.statista.com/statistics/270439/chinas-share-of-global-gross-domestic-product-gdp/); given the high level of interconnection of our economies it is not conceivable that an event of the scale of what happened in China could avert a global recession. The real problem remains the size of DEMAND at all levels of the supply chain, the world is well supplied (see: Oil which is a topic that deserves a posting all on its own) but DEMAND is lagging and the demand destruction caused by the virus is going to be massive.

Even prior to the virus going global the demand destruction in China would have had an impact on global GDP big enough to derail markets on its own.

Now the effect is compounded several times over and national governments are all individually adjusting to a new reality continuously off balance. The novelty of the issue on hand and the sheer size of it, the impacts of which are hard to identify yet.

The Italian government started with announcing a stimulus of €7B, only to revise it to €25B, and now adjusting it again. The EU Commission originally set €200M for the virus containment for the whole Eurozone.

There is no dip to buy yet, and the simple reasons for it are:

TIME: Nobody knows yet enough of the virus to understand whether warm weather is going to be enough to complete its cycle and therefore determine we are going to deal with it globally until Summer in the Northern Hemisphere or else. Or also if it is going to reappear next September or October. In essence, we understand from the Chinese experience that the outbreak may last 2 months, IF the country enacts draconian laws. Many countries don’t have the ability to enact those laws without risking rioting.

SIZE: We have not understood which measures each government is able to put in place to provide liquidity to consumers and keep businesses from shutting down and laying off a large portion of the productive systems.

We will start to see the real damage to the economy once Q1 & Q2 reports will come available and, in the meantime, appreciate how many companies will not be able to serve their existing operation or debt, specifically sectors such as: aviation, tourism, consumer driven SMEs.

3. NATIONAL GOVERNMENTS ROLE

The Coronavirus "COVID-19" emergency has brought to the forefront, the role of central governments as pivotal in handling the emergency. It has conversely uncovered the complete inadequacy and breakdown of supranational organizations like the European Union, and its commission, and the World Health Organization alike.

When emergencies reach an acute level, governments are willing to swiftly abandon treaties and solidarity formalities to resort to the law of the jungle, which if you allow me to point out, it is the one that supersedes all others in the international arena (see: Iraq, see Syria, see Rwanda, see Vietnam, see Afghanistan, etc. etc. etc.).

I think it has been particularly eye opening for Europeans, since this is the first time that the Union faces an emergency of this type and of this reach. German authorities blocked medical goods bought by Italian companies for several days while in transit via Germany to Italy. Only government to government negotiation unblocked those goods from being retained for local use, after the story was published on all media outlets. In the mean-time queues at the Polish – German borders are reported to have reached close to 50 kilometers.

A fact that exemplifies the breakdown of supranational organizations is represented by the mere fact that the EU commission suspended the Schengen zone only AFTER each country has taken their own measures independently: Austria, Germany, Italy, etc. A total failure.

Further, in spite of the role of the World Health Organization, each country has reported data about the contagion without any common protocol, therefore making it completely unreliable to compare data across countries. In Italy it is not even possible to compare data across regions as there is no homogeneous way of managing the testing for lack of resources from region to region.

The same breakdown is bound to take a new dimension as national governments will resort to plan the subsidies required to support the economy. We are definitely bound to see further deterioration of the existing rules, especially within the European Union.

It is rumored that Germany is about to start its own stimulus by issuing zero interest rate loans from a local credit institution and guaranteeing the credit via government bond purchases, entirely bypassing any EU institution. It is going to be interesting to see who is going to set up the first precedent effectively, further undermining the already feeble EU legal and economic framework.

4. EXTRA ORDINARY MEASURES TO CONTAIN THE DAMAGE

Many countries faced the COVID19 outbreak already with fragile economies as mentioned in an earlier part of this article. Needless to say, as you all know interest rates have been ultra-low globally following the never-ending QE enacted by most central banks.

It is therefore clear that monetary policy has less instruments in its arsenal than in the 2008 juncture. How far into negative territory is the ECB and the Feds are willing to go to prop up the economy and the financial markets?

Over the past 10 years plus, central banks have focused on providing liquidity to the financial system and focused on the sustainability of the banking system, fundamentally keeping in the market ghost banks like Deutsche Bank, Commerzbank, etc. etc.

Mind that as European consumers know well, in spite of the ECB QE money never trickled down to the household and consumers (Germany being the only exception thanks to its mercantilist policies, but that is also a topic for another article).

It is now time to focus on providing liquidity to households and consumers, fast and quickly. The mere postponing of tax obligations will fall quite short of what is needed.

Depending on how quickly the outbreak will take a hold of each country each government will have more or less time available to put together a series of SIMPLE and easy to implement policies to enable households to:

1, Retain their jobs

2, Front their basic financial obligations: mortgage payments, accrued taxes, pay utilities.

3, Front their basic needs: eat.

TIME will have a likely direct and exponential effect on the size of the economic contraction. The longer the time to address A, B, C the faster and more devastating will be the contraction.

The government that will be effective in addressing A, B, C, will be the government that will be ready to rebound out of the crisis with an employed workforce, companies in business ready to operate and a basic internal demand to support the economy.

Whoever will not address with SWIFT measures to A, B, C shall come out of this crisis with a crippled economy and massive unemployment, completely unable to collect taxes to serve the massive debt created.

5. COMPOUNDED EFFECTS FOR AGILE ECONOMIES

Agile and highly technological nation systems are bound to face deeper consequences given the following scenarios:

- Flexible workforce without a reliable welfare system;

- “Just in time” supply chains depending on foreign goods and services. Low stock levels;

- High level of consumer debt.

Flexible workforce and no welfare or unions means ultra-quick

layoffs adding to the number of people having a hard time making monthly

financial commitments.

Closed borders impair movement of goods and retooling the supply chain system

on the go is costly and difficult.

Further, high consumer debt compounds two systemic issues:

- Ability of consumers and households to manage time off work without resorting to bankruptcy.

- Ability of financial institutions to face high volumes of foreclosures and bankruptcies over a short period of time;

In conclusion, COVID19 came about as the famous black swan at the end of the longest expansion cycle in the history of the financial markets.

Unfortunately for us, although epidemics are not a new thing in the history of mankind, the nature of our interconnected and digital world makes us all the most aware of what is happening globally. Since WWII mankind hasn’t faced a global threat, and our generation is for the first time experiencing restricted movement, curfews and closed borders. A new experience and new challenges that redefine the roles of central banks and national governments right at the tail end of an era in which supranational organizations seemed to have represented the pinnacle of global integration and collaboration.

Author:

LUCA GORLERO, MBA

Founder & Chairman - Affinitas

Link to Bio: https://affinitasconsulting.com/about/#

Twitter: @gorlero

http://www.affinitasconsulting.com